Nesta

Date: 2019

Technical due diligence looks at the state of a startup’s technology and culture ahead of a potential investment, and asks whether they are fit for purpose—and what the future might hold.

I’ve run tech due diligence (DD) on a number of startups being considered for investment by Nesta’s venture capital arm, Nesta Impact Investments (a £17.6M fund). Each review involves time spent with the startup team, and an assessment using a specially-developed framework.

The result is a written report, with the goal of guiding a non-technical investor through the rest of their DD and, if the investment is made, into their early board meetings.

The process is suitable for seed to series A investments.

Assume honesty, but verify.

In tech DD, we’re not looking to check every line of code: we know the technology works otherwise the product wouldn’t be in market. Rather, we want to check those aspects on which the investment relies—for example, is it really going to be trivial to expand the product into a new vertical as claimed in the pitch deck? And does this startup, with its team and technology, show signs of being able to learn and adapt for the as-yet unknown challenges ahead?

My approach is to

- go broad, looking at core technology but also development processes and culture

- be sensitive to the stage of the startup, keeping in mind needs and norms

- consider the tech and processes holistically in the context of the business model, and the purpose of investment.

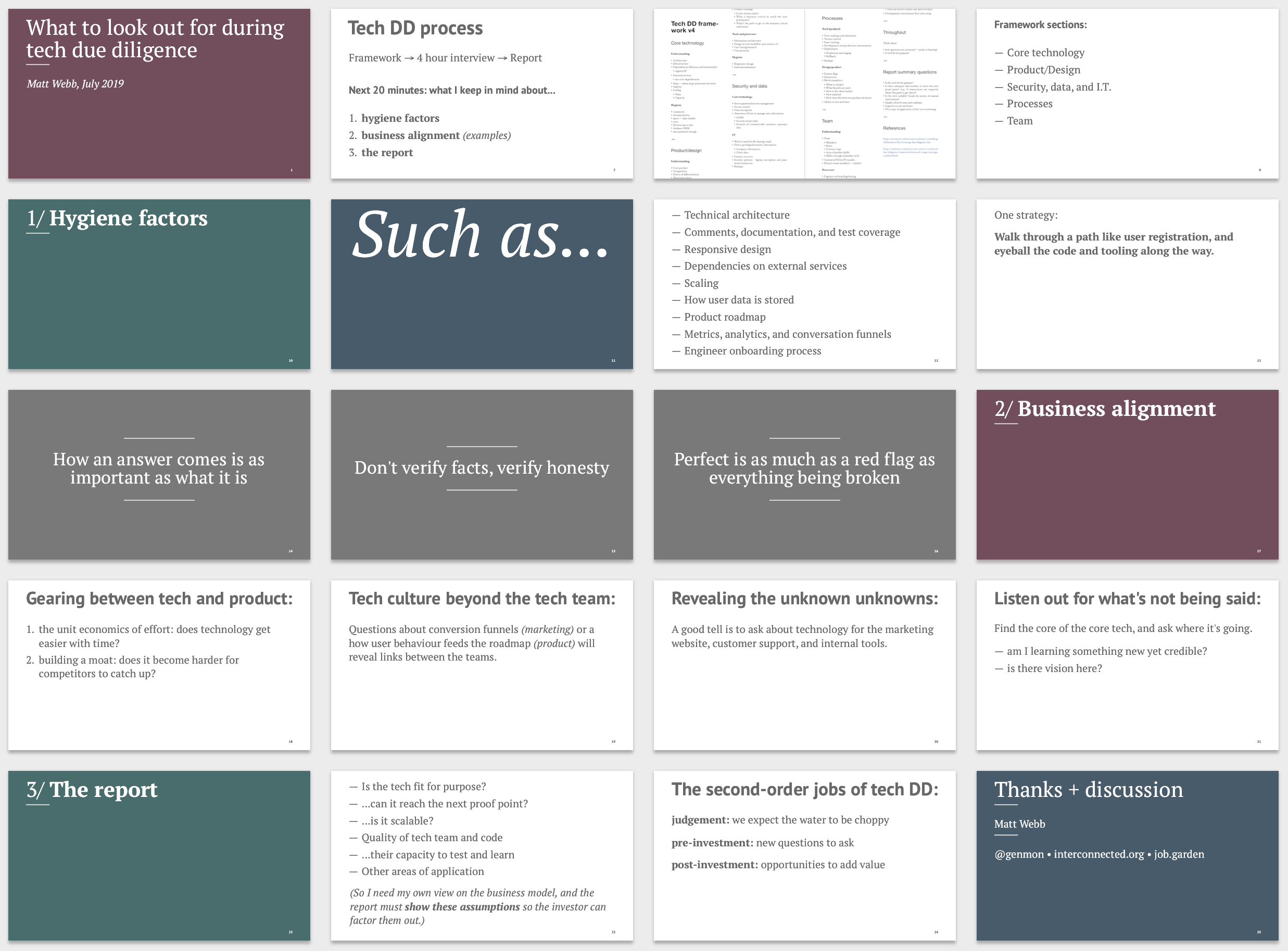

I’m happy to share my approach in the form of a talk (see slide thumbnails above) and discussion with the investment team.

A second pair of eyes on tech feasibility.

In 2019, I assessed the tech feasibility of applicants to the Affordable Credit Challenge, run by Nesta Challenges and HM Treasury.

For each application I produced a scorecard to inform the judges, breaking down the published assessment criteria.